Secure

your future

with us.

Part of the award winning Lifespan Adviser network and licensee — Omura Pty Ltd is a Corporate Authorised Representative (ASIC No. 1297963) of Lifespan Financial Planning Pty Ltd (AFSL: 229892)

Part of the award winning Lifespan Adviser network and licensee — Omura Pty Ltd

is a Corporate Authorised Representative (ASIC No. 1297963)

of Lifespan Financial Planning Pty Ltd (AFSL: 229892)

is a Corporate Authorised Representative (ASIC No. 1297963)

of Lifespan Financial Planning Pty Ltd (AFSL: 229892)

Omura Wealth Advisers help you make smart decisions today

for stronger wealth and peace of mind tomorrow.

for stronger wealth and peace of mind tomorrow.

Omura Wealth Advisers help you make smart decisions today for stronger wealth and peace of mind tomorrow.

Omura Wealth Advisers help you make smart decisions today

for stronger wealth and peace of mind tomorrow.

for stronger wealth and peace of mind tomorrow.

Part of the award winning Lifespan Adviser network and licensee — Omura Pty Ltd

is a Corporate Authorised Representative (ASIC No. 1297963)

of Lifespan Financial Planning Pty Ltd (AFSL: 229892)

is a Corporate Authorised Representative (ASIC No. 1297963)

of Lifespan Financial Planning Pty Ltd (AFSL: 229892)

Omura outperforms every public-offer Superfund in Australia

More information including disclaimers can

be found in our blog

be found in our blog

One year performance to 30 June 2024

Terry Vogiatzis named Adviser of the Year

Terry Vogiatzis named Adviser of the Year — Superannuation at the Australian Wealth Management Awards.

Award Announcement.avif)

.avif)

At Omura Wealth Advisers, we take a meticulous and strategic approach to financial management of your assets.

Our team of highly qualified financial experts provide tailored solutions that encompass investment strategies, superannuation planning, tax structuring and more.

Book a discovery callOur team of highly qualified financial experts provide tailored solutions that encompass investment strategies, superannuation planning, tax structuring and more.

Omura’s Model

Portfolio Performance

to 31 December 2024

.svg)

View full performance disclaimer

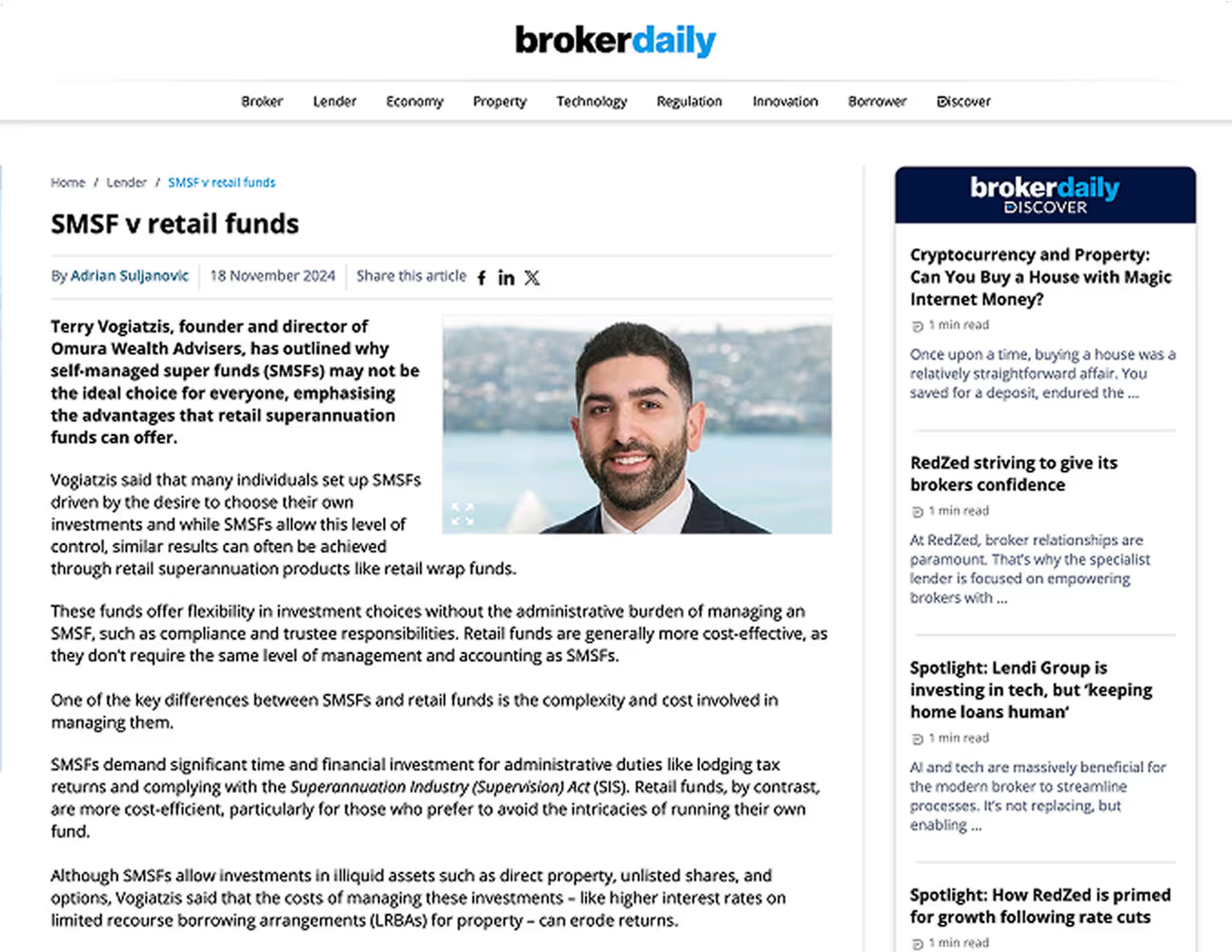

Featured in Leading Financial Publications

Our expertise is recognised and sought after by leading financial and business publications, where our team and Director, Terry Vogiatzis, provides industry insights, expert commentary and strategic perspectives on wealth management.

An Australian Wealth Management Partner You Can Depend On

Your Trusted Strategic Financial Advisory Firm in Sydney

.svg)

Are we right for you?

Speak to us todayWhat you can expect

What you won’t get

Convenient and digital processes. Most of our clients are time-poor professionals

Prehistoric ways of operating (paper and wet signatures) We won't ask you for informationyou've already provided

Reliability and accuracy

Work handed down and lost by junior staff

We check things twice and we do it right. We don't care how long it takes

Work rushed or outsourced

No in-house products or investments

Getting paid by a product to invest your money with them

We stay up to date with new investments and legislation. If there's a new or better way to make or save money, we're first to know.

Paying premium fees for advisers with out-dated knowledge, selling a large brand

We are a boutique only taking on a select number of clients. You will form a lifelong relationship with your adviser

Stuck the conveyor belt of departing advisers in a large firm

Personalised for you

Templated cookie cutter advice

Omura’s Investment Philosophy

We provide rigorous and strategic financial advice focused on your long-term security and success.

We challenge assumptions, conduct thorough research and explore every viable option to ensure the best financial outcome for your circumstances.

Our approach is rooted in transparency, precision and accountability, ensuring that every decision is made with your interests at the forefront.

With Omura Wealth Advisers, you can be confident that your wealth is managed with expertise, integrity and an unwavering commitment to delivering real results.

Our Investment PhilosophyOur approach is rooted in transparency, precision and accountability, ensuring that every decision is made with your interests at the forefront.

With Omura Wealth Advisers, you can be confident that your wealth is managed with expertise, integrity and an unwavering commitment to delivering real results.

Led by

Terry Vogiatzis

An Experienced and Results-Driven Financial Strategist

Terry Vogiatzis is a highly accomplished financial adviser, investment strategist and wealth management expert.

Terry spent the majority of his career providing financial advice at one of Australia’s largest Wealth Management firms to ultra-high-net-worth clients. Prior to providing advice, Terry worked as an accountant in the taxation and business advisory sector. Terry also assisted in building a cryptocurrency as Chief Investment Officer which achieved a valuation of $60m.

Terry is an industry thought leader and regularly contributes to industry media and publications

Learn more about TerryTerry spent the majority of his career providing financial advice at one of Australia’s largest Wealth Management firms to ultra-high-net-worth clients. Prior to providing advice, Terry worked as an accountant in the taxation and business advisory sector. Terry also assisted in building a cryptocurrency as Chief Investment Officer which achieved a valuation of $60m.

Terry is an industry thought leader and regularly contributes to industry media and publications

Insights & Resources

Learn about the latest in trusted wealth management for Australians.

Gain expert insights on Wealth Management

An Experienced and Results-Driven

Financial Strategist

Financial Strategist

.svg)

.avif)

.avif)

.avif)

.svg)

.svg)

.avif)

.png)