Our investment

philosophy

Our Investment Process

At Omura, we are believers of being armed with knowledge, whilst being aware of what is impossible to predict.

Our philosophy, which is backed up by numerous studies, is that It is impossible to add value over the long term by attempting to time the market. However, we do believe it is possible to determine the relative attractiveness of different asset classes at a point of time by using current valuations, earnings forecasts, and other indicators to forecast long term returns.

We are also comfortable admitting to ourselves that no one organisation can be the best at everything.

Therefore, our approach to building investment portfolios involves partnering with:

Leading asset allocation specialists

Leading investment managers in each asset class

Combining their collective expertise to create best of breed diversified portfolios

Asset allocation

Asset allocation refers to the decision of what mix of different assets to hold in your portfolio at any given time. When done right, asset allocation may reduce risk and enhance returns.

There are many asset classes to invest in with a range of risk and potential return outcomes. The graph below is an example of the historical risk and return of a selection of asset classes over the past 20 years.

Omura partners with leading asset allocation consultants, allowing us to be nimble and increase or decrease exposure to different asset classes on a quarterly basis. This is referred to as dynamic asset allocation.

Our latest asset allocation calls (March 2022)

Our portfolios’ continued overweight to alternatives (gold) and infrastructure allowed us to minimise the impact from the recent drop in the share markets.

Our asset allocation consultants also managed to reduce our share exposure at the top of the market in March!

Sub-asset classes and sectors

Each asset class has sub-asset classes and different sectors. Deciding on how to allocate within each asset class also requires specialist input. As such, frequent review is required based on prevailing market conditions and opportunities.

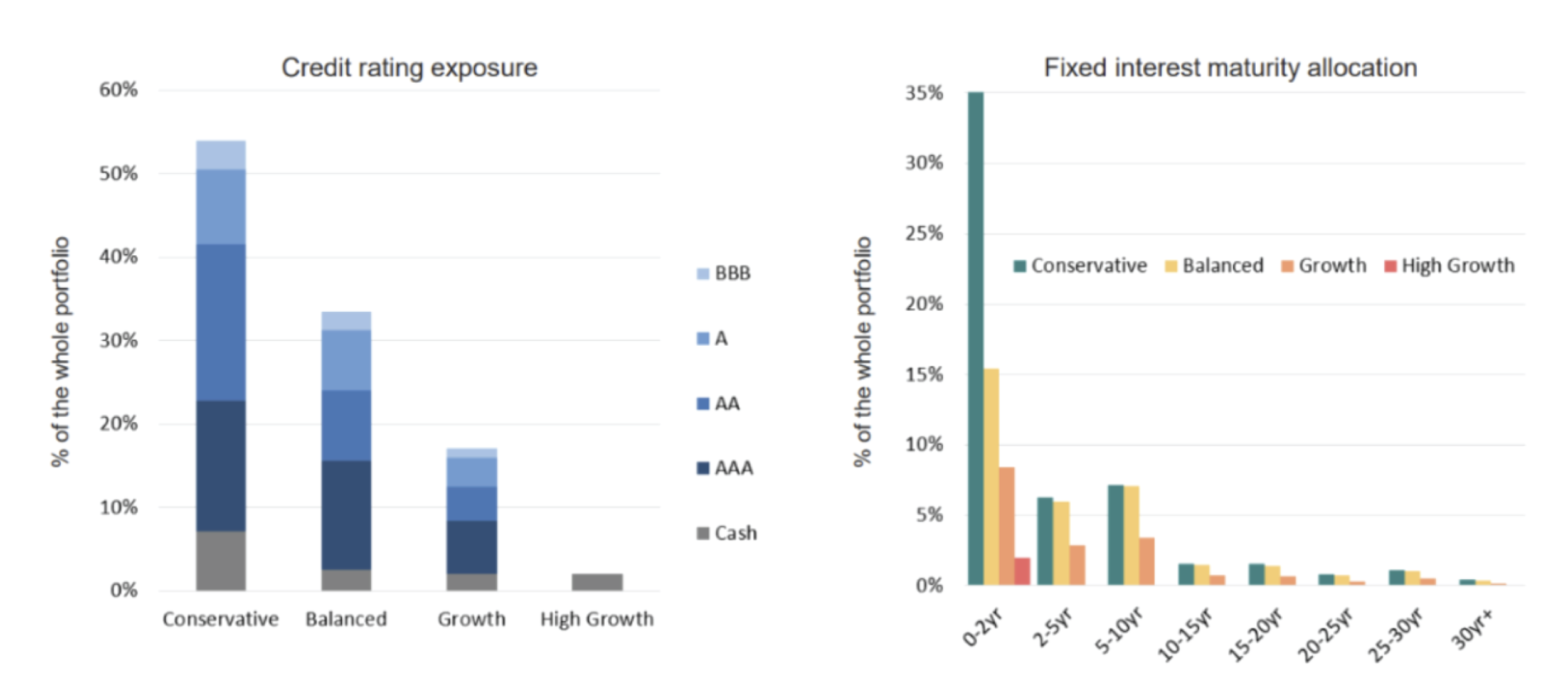

An example below is our bond exposure, which requires allocating between different levels of maturity duration and credit rating.

The result - Reduced Risk

Below are the historical drawdowns (negative returns) of our diversified Balanced portfolios compared to the ASX 200

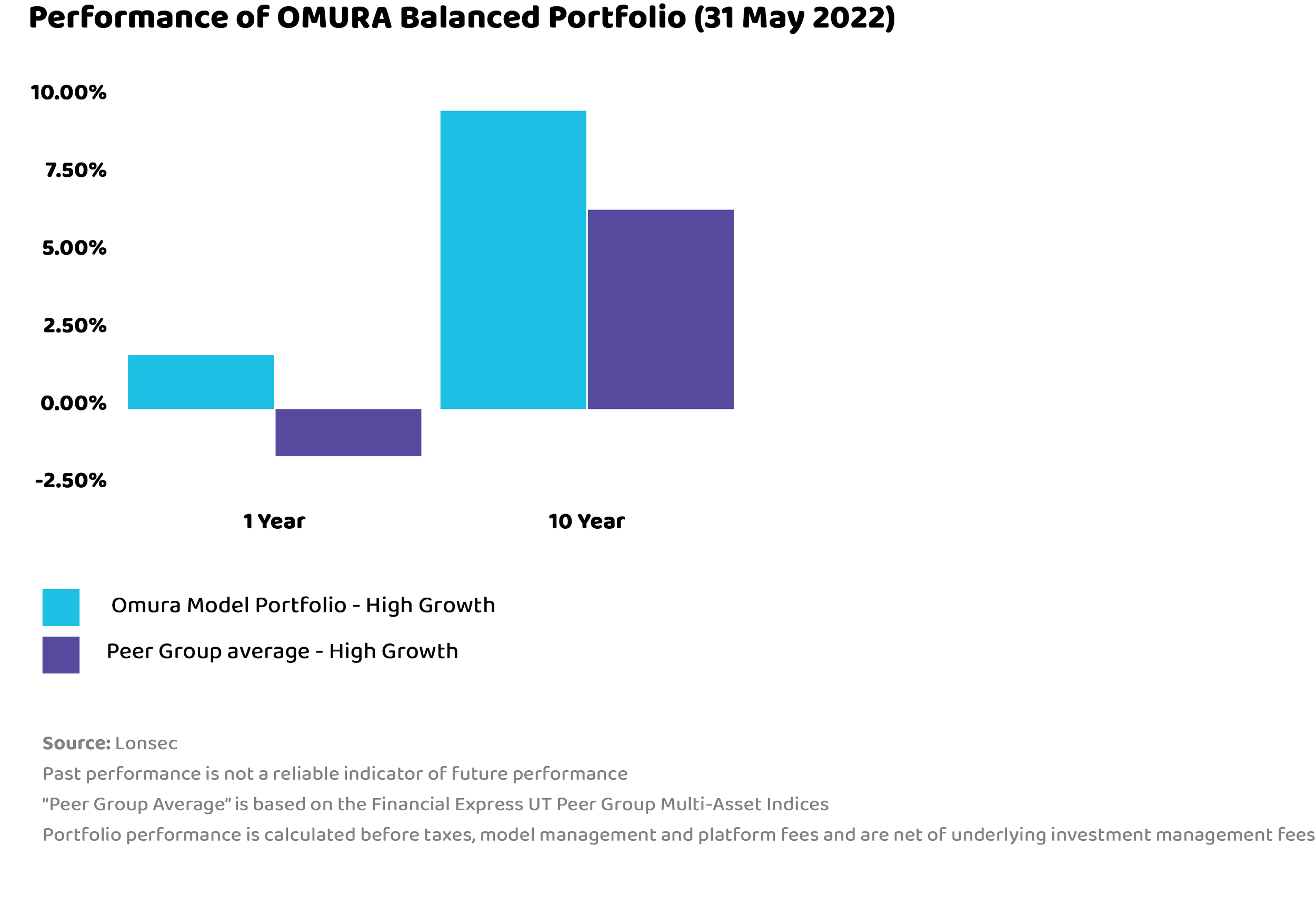

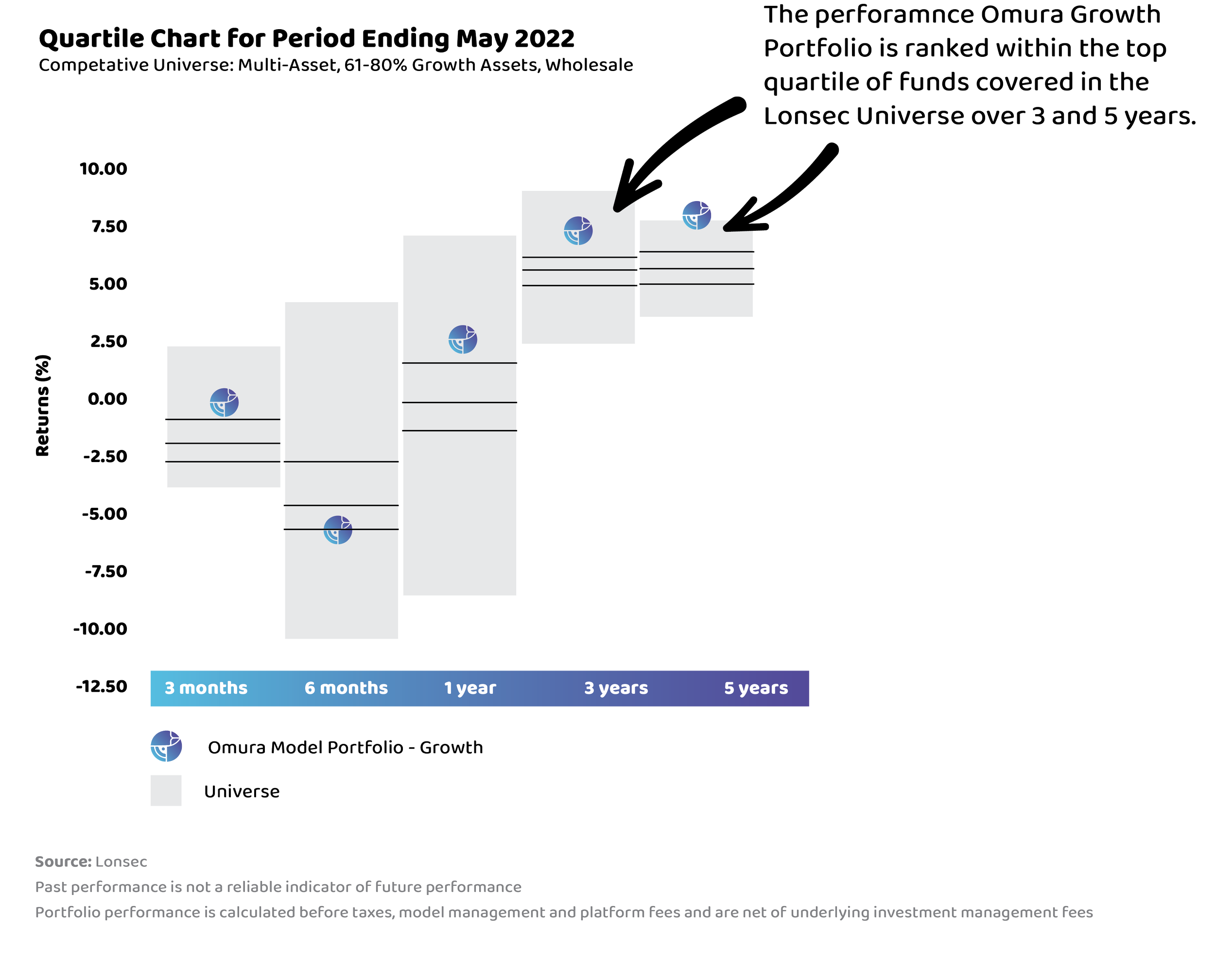

Enhanced performance

FAQs

-

There are many different types of portfolio management. They can generally be subcategorised as Active vs Passive management, and Dynamic vs Static asset allocation.

Active management involves picking a select number of investments, in an attempt to outperform the broader index of all investments.

Passive management involves investing in an index, such as the ASX 200, S&P 500, NASDAQ 100, etc. The idea is to hold a large diversified amount of investments at a low cost.

Static asset allocation refers to maintaining a consistent weight to each asset class.

Dynamic asset allocation refers to changing your asset allocation, generally per quarter, to try and take relative tilts on which asset class is most in favor.

-

The cost of portfolio management can vary depending on a person’s needs and the type of portfolio management. With that said, advisors and managers typically charge 1% of the assets they manage. However, keep in mind that the rates may vary depending on a number of factors.

-

Managing your open investment portfolio can help people save money. After all, the advice fee of financial advisors can add up over time. However, outsourcing your portfolio management allows a skilled manager to invest for you and reduce the chances of making costly mistakes.

Financial advisors and portfolio managers spend a lot of time and effort analysing the market. This gives them a lot of expertise and credibility to find the right investments to make at the right time.